Do you interested to find 'mcgraw hill connect accounting homework answers chapter 6'? You can find all the information here.

Table of contents

- Mcgraw hill connect accounting homework answers chapter 6 in 2021

- Connect answer key accounting

- Answers to mcgraw hill accounting

- Mcgraw hill accounting answer key

- Financial accounting connect answers

- Mcgraw hill connect accounting homework answers chapter 6 06

- Mcgraw hill connect accounting homework answers chapter 6 07

- Mcgraw hill connect accounting homework answers chapter 6 08

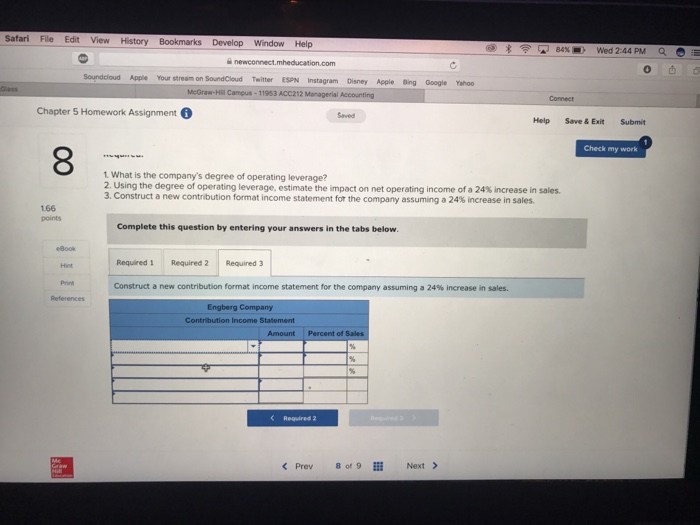

Mcgraw hill connect accounting homework answers chapter 6 in 2021

This picture representes mcgraw hill connect accounting homework answers chapter 6.

This picture representes mcgraw hill connect accounting homework answers chapter 6.

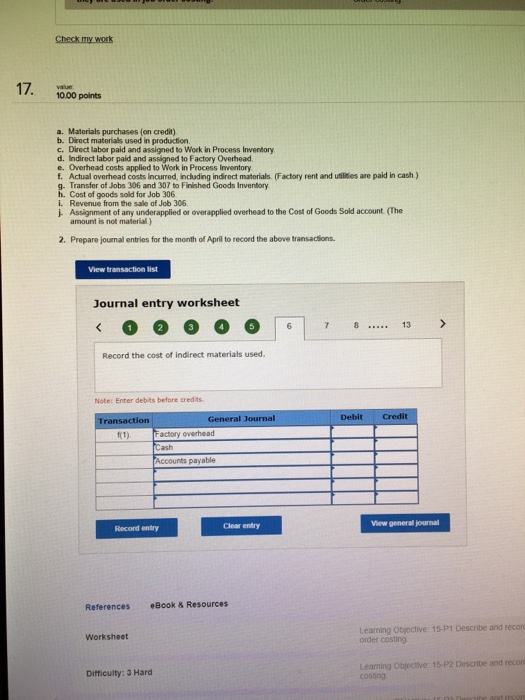

Connect answer key accounting

This image demonstrates Connect answer key accounting.

This image demonstrates Connect answer key accounting.

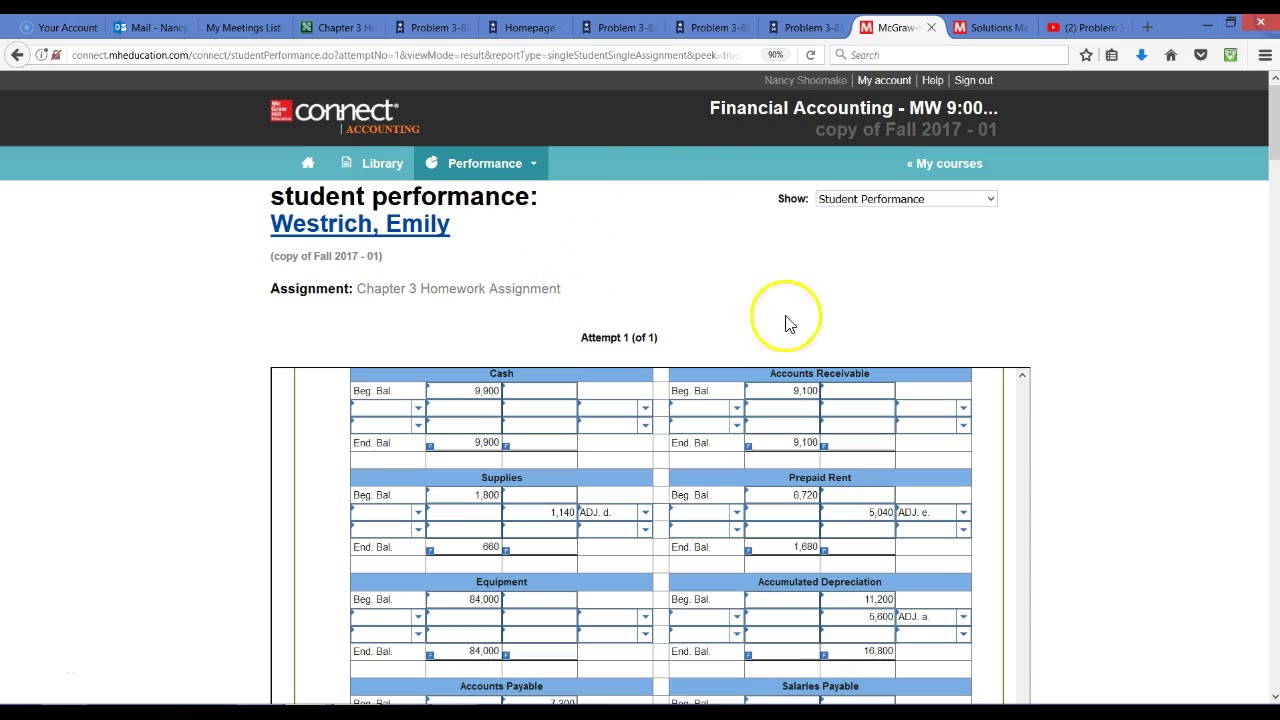

Answers to mcgraw hill accounting

This image shows Answers to mcgraw hill accounting.

This image shows Answers to mcgraw hill accounting.

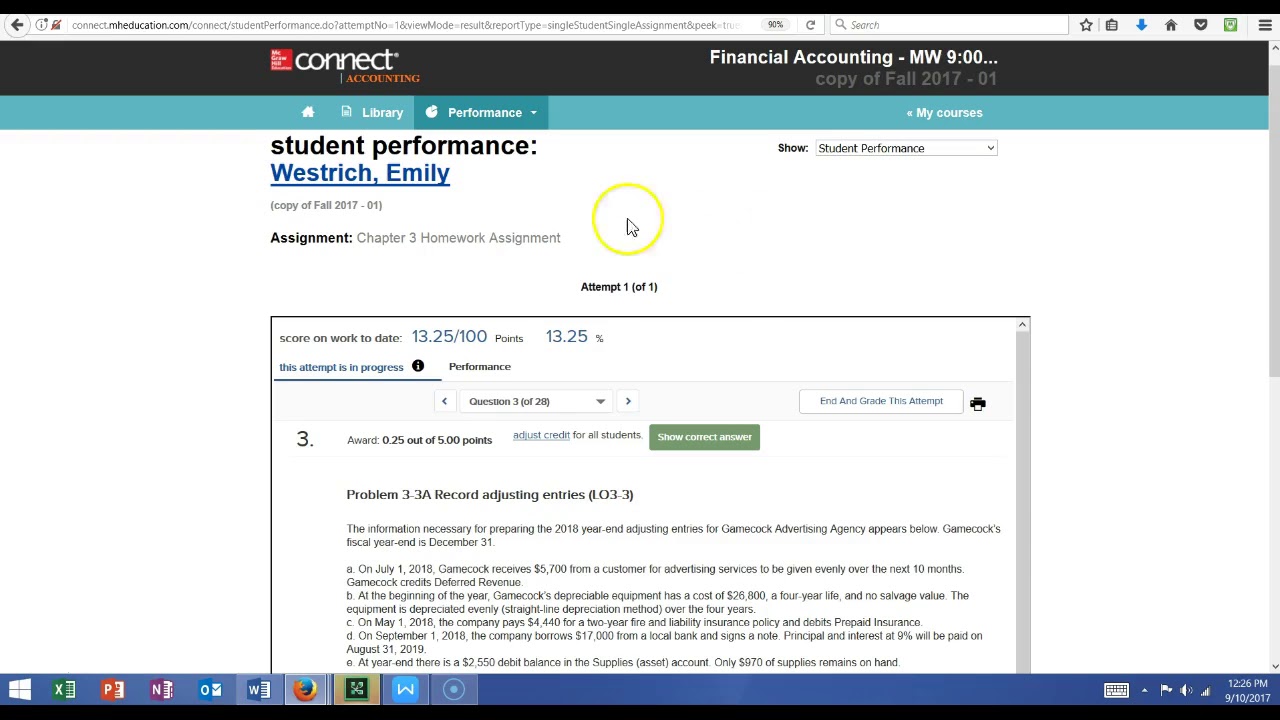

Mcgraw hill accounting answer key

This image representes Mcgraw hill accounting answer key.

This image representes Mcgraw hill accounting answer key.

Financial accounting connect answers

This image representes Financial accounting connect answers.

This image representes Financial accounting connect answers.

Mcgraw hill connect accounting homework answers chapter 6 06

This image representes Mcgraw hill connect accounting homework answers chapter 6 06.

This image representes Mcgraw hill connect accounting homework answers chapter 6 06.

Mcgraw hill connect accounting homework answers chapter 6 07

This image illustrates Mcgraw hill connect accounting homework answers chapter 6 07.

This image illustrates Mcgraw hill connect accounting homework answers chapter 6 07.

Mcgraw hill connect accounting homework answers chapter 6 08

This image demonstrates Mcgraw hill connect accounting homework answers chapter 6 08.

This image demonstrates Mcgraw hill connect accounting homework answers chapter 6 08.

When do the McGraw Hill bonds pay interest?

Prepare the journal entries to record the first two interest payments. Hillside issues $2,200,000 of 7%, 15-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $2,692,790.

How does McGraw Hill connect help with homework?

We at Accounting Assignments Help provide Mcgraw-hill Connect Homework Help and Mcgraw-hill Connect Exam Help with step by step calculation and explanation 24*7 from our professional experts for following topics. Keesha Co. borrows $255,000 cash on November 1, 2017, by signing a 120-day, 11% notes with a face value of $255,000.

How to calculate tax deductions for McGraw Hill?

Compute his regular pay, overtime pay (for this company, workers earn 150% of their regular rate for hours in excess of 40 per week), and gross pay. Then compute his FICA tax deduction (use 6.2% for the Social Security portion and 1.45% for the Medicare portion), income tax deduction, total deductions, and net pay.

Last Update: Oct 2021